125% Rule for In-State Tuition

The Code of Virginia establishes rules for eligibility for in-state tuition for all students enrolled at public institutions in the Commonwealth of Virginia. Section 23.1-509 of the Code of Virginia further requires undergraduate students to maintain progress toward the degree to comply with continued eligibility for in-state tuition. Students with entry dates Fall 2006 and after may not exceed attempted hours that total 125% of the minimum credit hours needed for a specific degree program and retain in-state tuition eligibility. Students exceeding 125% will be assessed a surcharge for each semester of continued enrollment after exceeding the credit hour threshold. For the purpose of this state law, all credits attempted (Virginia Tech and Transfer) are used in the calculation of the percentage. The requirement does allow the subtraction of credits awarded for Advanced Placement, Advanced Standing, International Baccalaureate, and Credit by Exam from the attempted totals. Important resources to assist you so as to avoid the credit hour surcharge include:

- Credit Hour Surcharge Costs, Virginia Tech Bursar. Click on the relevant term link. Please note that the Excess Credit Hour Tuition surcharge is per credit hour. To calculate the total surcharge for a term, multiply the surcharge amount per credit hour by the number of credit hours enrolled (up to 12 credit hours per semester in Fall and Spring terms).

- State Code of Virginia, Section 23.1-509

Filing Appeals:

Students may file an appeal of the credit hour surcharge based on one or more of the following reasons:

- Medical documentation of illness

- Medical documentation of a disability

- Documentation of active services in the armed services military

- One time major change from a degree-seeking major to another degree-seeking major.

Documentation and letter of appeal may be forwarded to:

Office of the University Registrar

250 Student Services Building (0134)

Virginia Tech, Blacksburg, VA 24061

How many credits can I attempt before violating the 125% Rule and how can I calculate my limit/threshold?

The credit hour threshold refers to the number of credit hours that can be attempted before violating the 125% Rule for In-State Tuition. This number varies from student to student. One of the most important pieces to understanding the 125% Rule, is the timing in which the credit hour threshold is determined. The 125% Rule credit hour threshold is determined at the time the student receives the initial warning notice (email from the Office of the University Registrar).

The warning notice is sent to all students who receive In-State tuition, once they have attempted (attempted hours = VT coursework + transfer credit + in-progress coursework + pre-registered coursework) 100% of the required hours of their primary degree program. Students may receive the warning email more than once. The calculation on which the warning notice is based is automated and does not account for many factors that can affect an individual student's standing (additional degrees, minors, etc.). The warning email serves two main purposes.

- The warning email informs the student that they have attempted the number of hours required to graduate with his/her primary degree, are paying In-State tuition, and thus, may be approaching violation of the 125% Rule. *The limit/threshold has NOT been exceeded when the warning email is received, but based on mass-generated, automated calculations, the student may be getting close*.

- The initial receipt of the warning email “locks-in” the student’s specified/declared degree program. The specified degree program consists of a) primary major + b) additional/dual degrees + c) minors. All additional degrees/minors MUST be applied for/declared as such on the student record for them to be included as part of the specified degree program. Double majors are not included and do not increase a student’s 125% rule limit. At the time of the receipt of the initial warning email, the student’s specified degree program is locked-in. This means that whatever the specified degree program is at the time of the initial warning is the basis of the student’s 125% Rule threshold, and it will remain that way. Obviously, students are free to make changes to their degree programs after this warning notice, but any changes will have NO EFFECT on their 125% threshold.

- Hours Required to complete the primary degree on the student record at the time of the receipt of the initial warning.

- If an additional/dual degree has been declared and applied for as such at the time of the receipt of the initial warning, 30 hours will be for each additional degree.

- The hours required to complete each minor that was declared on the student record at the time of the initial warning.

- At the time the initial warning notice was received, Student A had a specified degree program of: Bachelor of Science in Chemistry as a primary degree (120 required hours), no additional degree(s), and no minor(s):

125% x (120 hours) = 150 hours

Student A has a 125% Rule credit hour threshold of 150 hours.

- At the time the initial warning notice was received, Student A had a specified degree program of: Bachelor of Science in Psychology (120 required hours), an additional degree of Bachelor of Arts in Economics (30 additional required hours), a minor in History (18 required hours).

125% x (120 hours + 30 hours + 18 hours) = 210 hours

Student B has a 125% Rule credit hour threshold of 210 hours.

The 125% Rule Evaluation Audit

The Office of the University Registrar has developed a tool within the Degree Audit Systems (DARS) to provide students with an opportunity to run a “What-If” degree audit to provide a rough outline of their standing with the 125% Rule at DEGREE AUDIT MENU. The instructions for running the 125% Rule Evaluation audit are below:

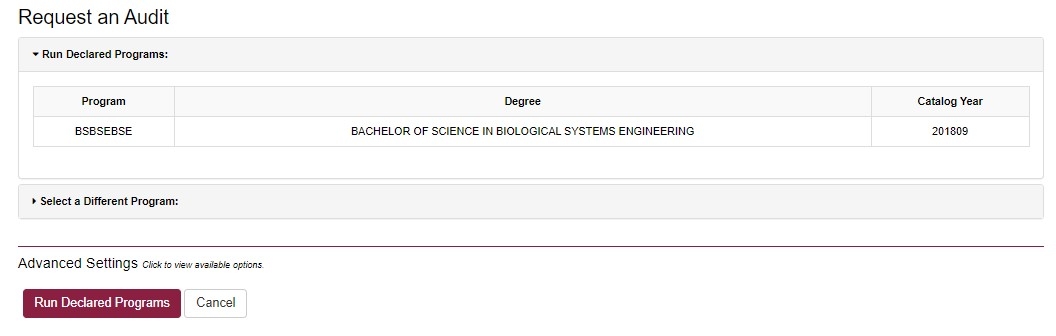

1. From the Request an Audit screen, click “Select a Different Program:”

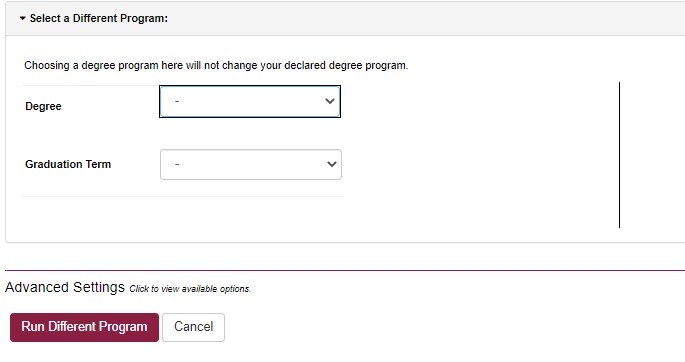

2. From the Degree dropdown menu, select 125% Rule for In-State Tuition Evaluation and from the Graduation Term dropdown menu, select your graduation term. Then, click on Run Different Program.

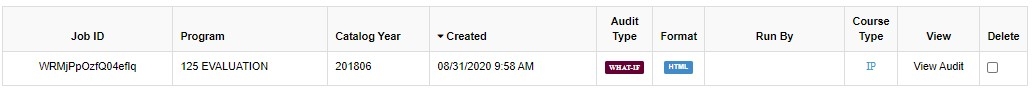

3. An Evaluation audit will be generated. Click View Audit to see the evaluation.

4. The evaluation audit will be displayed. To review the audit, click the arrow next to the red X and the evaluation will display.

**PLEASE NOTE** – The 125% Rule for In-State Tuition Evaluation Tool is a generalized evaluation and the credit hour threshold is not specific to each individual student. For the purposes of this generalized evaluation, the credit hour threshold is fixed at 150 hours. This represents the minimum credit hour threshold for any undergraduate student at Virginia Tech. It is possible that not all transfer hours will contribute towards the total attempted hours. Any transfer credit earned before high school graduation, attempted at a private institution, or attempted at an institution outside of the State of Virginia does not contribute to the attempted hours. Depending on your specified degree program, your credit hour threshold may be more than the fixed 150-hour threshold used in this calculation – additional credits may need to be added or removed from contributing to the attempted hours. For a full, detailed evaluation of your specific standing with the 125% Rule for In-State Tuition, please contact VA125Rule@vt.edu.**

Q: Are there any limitations placed on in-state tuition? If so, what are they?

A: To maintain in-state tuition rates, students must graduate by the time they have attempted 125% of the minimum credit hours required for their declared (specified) degree programs (This includes any Major, Double Majors, Options, Minors, and Additional Degrees).

Q: What happens if I do not graduate by the time my “credit-hours-attempted” exceeds 125% of the minimum credit hours required for my declared degree program?

A: Students who do not graduate by the time they have attempted 125% of the minimum credit hours required for their specified degree programs will incur a tuition surcharge.

Q: What is a Tuition Surcharge?

A: The tuition surcharge is the additional tuition that students must pay for continued enrollment after their attempted credit hours equal or exceed 125% of the minimum credit hours required for their declared degree programs.

Q: Concerning in-state tuition rates, what may be counted as comprising the minimum hours required for my declared degree program?

A: Your specified degree program consists of your primary degree, additional degrees (not double majors), and any minors. In order for these to be counted towards your DECLARED degree program, you must have applied for all degrees and minors that you are pursuing.

Q: What is meant by DECLARED degree program?

A: Your declared (specified) degree program consists only of those degrees, majors, and minors that you have applied for on the Application-for-Degree form on Hokie Spa.

Q: What is meant by the term “Credit Hour Threshold”?

A: The credit hour threshold is 125% of the minimum number of credit hours required to complete your declared degree program. Any attempted hours beyond this threshold trigger the tuition surcharge.

Q: Is there anything on my declared degree program which does not increase my 125% threshold?

A: Yes, double majors and major concentrations (options) do not increase the credit hour threshold.

Q: I am told that I must take a class each semester to remain a member of the Regimental Band. Can these classes be used to increase my credit hour threshold?

A: No. Only those courses specified by your declared degree program can be used to determine your credit hour threshold.

Q: As a member of the VT Corps of Cadets, I am told that I must take certain classes to remain a member of the Corps. Can these classes be used to increase my credit hour threshold?

A: No: Only the courses required of your specified degree program may be used to increase your credit hour threshold.

Q: Does declaring an additional degree increase the credit hour threshold?

A: Yes, a declared additional or dual degree will add a minimum of 30 credit hours to the total required to complete the degree. However, the additional degree must be declared no later than the acadmeic year prior to the term in which you exceed the credit hour threshold. Each declared minor will also increase the total degree hours by the minimum required hours to complete the minor.

Q: Can I change my declared (specified) degree program?

A: Yes, you can change your specified degree program at any time however please be aware changing majors may necessitate additional coursework which could cause you to exceed the credit hour threshold and incur the tuition surcharge. You should work with your course advisor to carefully plan your degree program so that you are able to accomplish your academic goals and avoid the tuition surcharge.

Q: At what point in my academic career is the credit hour threshold determined?

A: The credit hour threshold is determined based on your academic record at the time the final notification email is issued (Please see “warning email” question below). Adding additional majors or minors after this time will not alter the credit hour threshold calculations. After this point in time, changing your specified degree program will not affect your threshold in any way.

Q: What happens if I cross the 125% credit hour threshold?

A: Students who exceed the credit hour threshold must pay a tuition surcharge for each term of enrollment after crossing the threshold. This tuition surcharge is essentially double the normal in-state tuition rate.

Q: What credits are included in determining my standing relative to the 125% threshold?

A. All attempted Virginia Tech credit hours (where tuition was not refunded - e.g., obsolete credit), as well as transfer credit work from Virginia collegiate institutions are used in your standing relative to the credit hour threshold.

Q: Is there anything that does not count against my credit hour threshold?

A: Yes, the State Guidelines allow for the subtraction of credits awarded for high school dual enrollment, Advanced Placement, Advanced Standing, International Baccalaureate, and Credit by Exam from the attempted totals. Transfer credits from non-Virginia public colleges and universities may also be excluded from the credit hours attempted totals.

Q: Can I drop transfer credit to avoid this surcharge?

A: No. Effective Spring 2023, students do not have the option at Virginia Tech to choose to disallow transfer credit. All Virginia public institution transfer credit, with the exception of high school dual enrollment and credits disallowed by university requirement, must be used in the 125% credit hour threshold calculations.

Q: Is there anything I can do to avoid violating this regulation?

A: Absolutely! It is very important that you consult with your academic advisor and review the resources available on this page.

Planning for the completion of your degree requirements prior to reaching the credit hour threshold is critical in avoiding the tuition surcharge. In many, if not all cases, proper planning and compliance with university guidelines will prevent the application of the tuition surcharge. It is therefore imperative that you work with your academic advisor to clearly define your academic program and to declare all the degrees and minors you are pursuing.

Q: Can I appeal to have the Surcharge waived once it has been applied to my account?

A: While the Code of Virginia allows for a tuition surcharge waiver process, the standards set forth in the State Guidelines are both limited and rigorous. For more information on tuition surcharge waiver criteria, please refer to the SCHEV regulations.

Q: What types of notifications can I expect to receive concerning this regulation?

A: You may receive the below email types.

- The first is a warning email. The purpose of this warning email is to inform you that you have attempted the minimum hours necessary to complete your degree. At the time you receive this email you will not have triggered the tuition surcharge, but you are getting close. You may receive more than one warning email.

- The second is a final notification email. This email is sent to your during your senior year. Changing your specified degree program after the date of this email will not change the basis of your credit hour threshold.

- The third email, which is sent only to those students who have crossed the 125% threshold, notifies them that they will be assessed the tuition surcharge. Through careful planning and diligent study, you should avoid receiving this email.

**PLEASE NOTE**

The above concerns certain limitations on In-State Tuition, sometimes referred to as the 125% Rule for In-state Tuition. Please be aware that certain financial aid programs use similar or identical terminology. This notification does not deal with Reasonable Academic Progress (RAP) or Satisfactory Academic Progress (SAP) or any other financial aid regulations. To determine if financial aid will be affected by the application of the 125% In-State Tuition Surcharge, please contact the Office of University Scholarships and Financial Aid.